How the Importance of Risk Management Facilitates Successful Project Outcomes

How the Importance of Risk Management Facilitates Successful Project Outcomes

Blog Article

Why the Significance of Risk Management Can not Be Ignored in Today's Economy

In today's quickly evolving economic landscape, the duty of Risk Management has actually ended up being pivotal. The increasing volatility of markets, paired with rising unpredictabilities, necessitates a robust device to determine and reduce possible threats. Failure to do so can lead to extreme financial and reputational consequences, not just for specific organizations, however likewise for the wider economy. This increases a vital inquiry: can the importance of Risk Management in making sure security and sustainability be ignored? The adhering to discussion intends to explore this in higher depth.

Understanding the Idea of Risk Management

The Duty of Risk Management in Today's Economy

Having actually understood the concept of Risk Management, we can currently discover its function in today's economy. In the context of an unpredictable economic landscape marked by fast global events and technological adjustments, Risk Management ends up being a crucial strategic element, contributing to the stability, sustainability, and general strength of economic situations on both a macro and mini scale.

The Effect of Disregarding Risk Management

Overlooking Risk Management can result in alarming consequences for any business or economic climate. When prospective risks are not identified, examined, and alleviated, organizations subject themselves to unanticipated and commonly substantial damages. These could materialize as financial losses, reputational damages, operational disruptions, or perhaps legal difficulties. Moreover, in today's unstable economic environment, an unforeseen dilemma can swiftly rise, leaving an ill-prepared business rushing for survival. The international economic dilemma of 2008 functions as a plain pointer of the devastating impact that neglecting Risk Management can carry the economic climate at large. Therefore, ignoring Risk Management not just endangers private companies yet can destabilize the entire economic situation, emphasizing the critical duty played by effective Risk Management in today's financial landscape - importance of risk management.

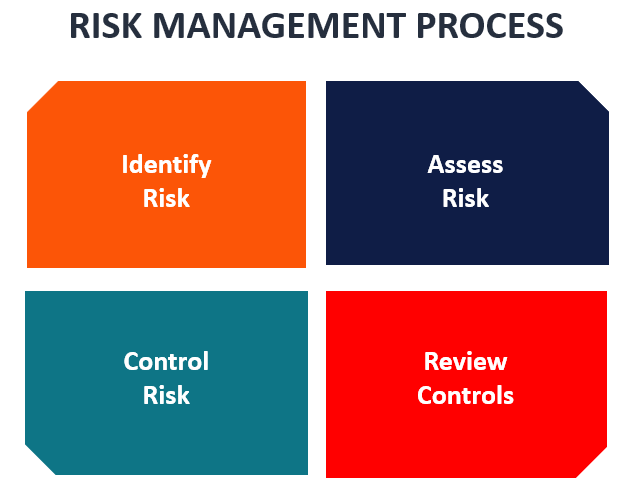

Key Elements of Reliable Risk Management Techniques

Reliable Risk Management approaches focus on 2 vital elements: carrying out and determining potential threats mitigation steps. To make sure the stability and sustainability of a service, these aspects must not be neglected. In the adhering to discussion, these essential elements will certainly be discovered thoroughly.

Determining Potential Risks

Why is identifying possible risks critical in any type of Risk Management approach? Recognition of prospective risks is the keystone of any type of efficient Risk Management method. On the whole, the process of identifying potential risks is an important action in fostering company strength and promoting sustainable growth.

Carrying Out Mitigation Steps

Browsing with the volatile look at this website business waters, organizations embark on the essential trip of implementing mitigation measures as part of their Risk Management techniques. These measures, created to minimize the influence of prospective risks, form the foundation of a durable Risk Management plan. They incorporate different strategies, consisting of moving the Risk to one more event, preventing the Risk, decreasing the negative impact or likelihood of the Risk, or perhaps accepting some or all the repercussions of a certain Risk. The selection of strategy depends upon the company's certain context, Risk resistance, and ability to birth losses. Effective mitigation calls for mindful planning, routine modification, and consistent vigilance. In an unstable economic situation, these steps increase resilience, making certain published here long-lasting survival and growth.

Case Studies: Effective Risk Management in Method

Despite the intricacies involved, there are a number of circumstances of effective Risk Management in practice that show its important function in company success. The car manufacturer quickly developed a threat Management team that minimized manufacturing downtime by identifying alternate suppliers. These instances underscore that successful Risk Management can not only protect companies from possible threats however likewise allow them to seize possibilities.

Future Fads in Risk Management: Adjusting to a Dynamic Economic Climate

Looking in advance, the landscape of Risk Management is poised for significant changes as it adapts to a dynamic economy. Technical developments are expected to change the field, with automation and synthetic intelligence playing a key role in Risk identification and mitigation. At the same time, the raising complexity of international markets and the changability of geopolitical occasions are making Risk Management more challenging.

Final thought

In final thought, Risk Management plays an essential role in today's interconnected and unpredictable economic situation. As the economic climate proceeds to progress, so need to helpful hints run the risk of Management approaches, emphasizing its recurring value in an ever-changing service landscape.

A correct Risk Management method is not concerning getting rid of risks entirely - a task almost difficult in the volatile world of business. Thus, disregarding Risk Management not only endangers specific businesses yet can destabilize the entire economy, highlighting the pivotal function played by efficient Risk Management in today's economic landscape.

Effective Risk Management techniques revolve around 2 key parts: implementing and determining prospective risks reduction steps.Why is identifying possible dangers important in any type of Risk Management technique? They incorporate numerous approaches, consisting of transferring the Risk to one more celebration, staying clear of the Risk, lowering the unfavorable impact or probability of the Risk, or even approving some or all the effects of a particular Risk.

Report this page